AutoFinance

SME Finance Toolkit with AI-Driven Actionable Financial Insights for Growth and Compliance

AutoFinance

SME Finance Toolkit with AI-Driven Actionable Financial Insights for Growth and Compliance

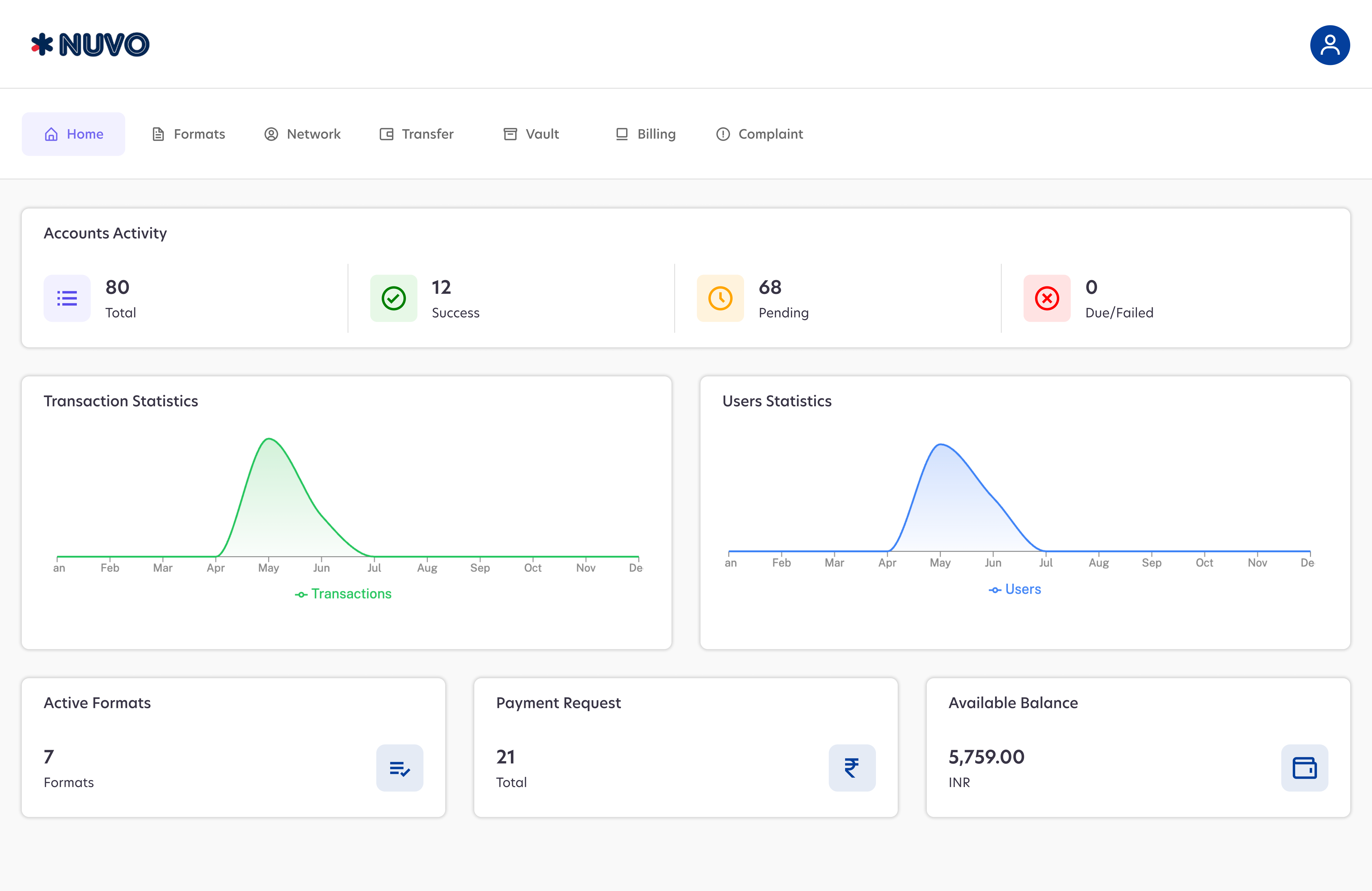

Automate Financial Management

Our AI-powered platform simplifies financial management for small and medium enterprises by analyzing bank statements to deliver actionable insights, cash flow trends, and compliance-ready reports.

Real-time Data Insights

Access live financial data for better tax planning and compliance advisory throughout the year.

90% Faster Processing

Eliminate manual data collection and entry, Instant access to Bank Statements, Investments and Financial Records.

Automated Compliance

Generate ITR, MCA Forms, GST returns, and Compliance reports automatically from real-time Financial Analytics using AI-ML.

Simplify Your Business Data Management

Feature-rich Solution to Automate Financial Data Analysis and Compliance Reporting usign AI-ML

Run Your AutoFinance in 3 Simple Steps

Experience the future of Business Accounting with Automated AI analysis, streamlined Data Sharing and Collaboration

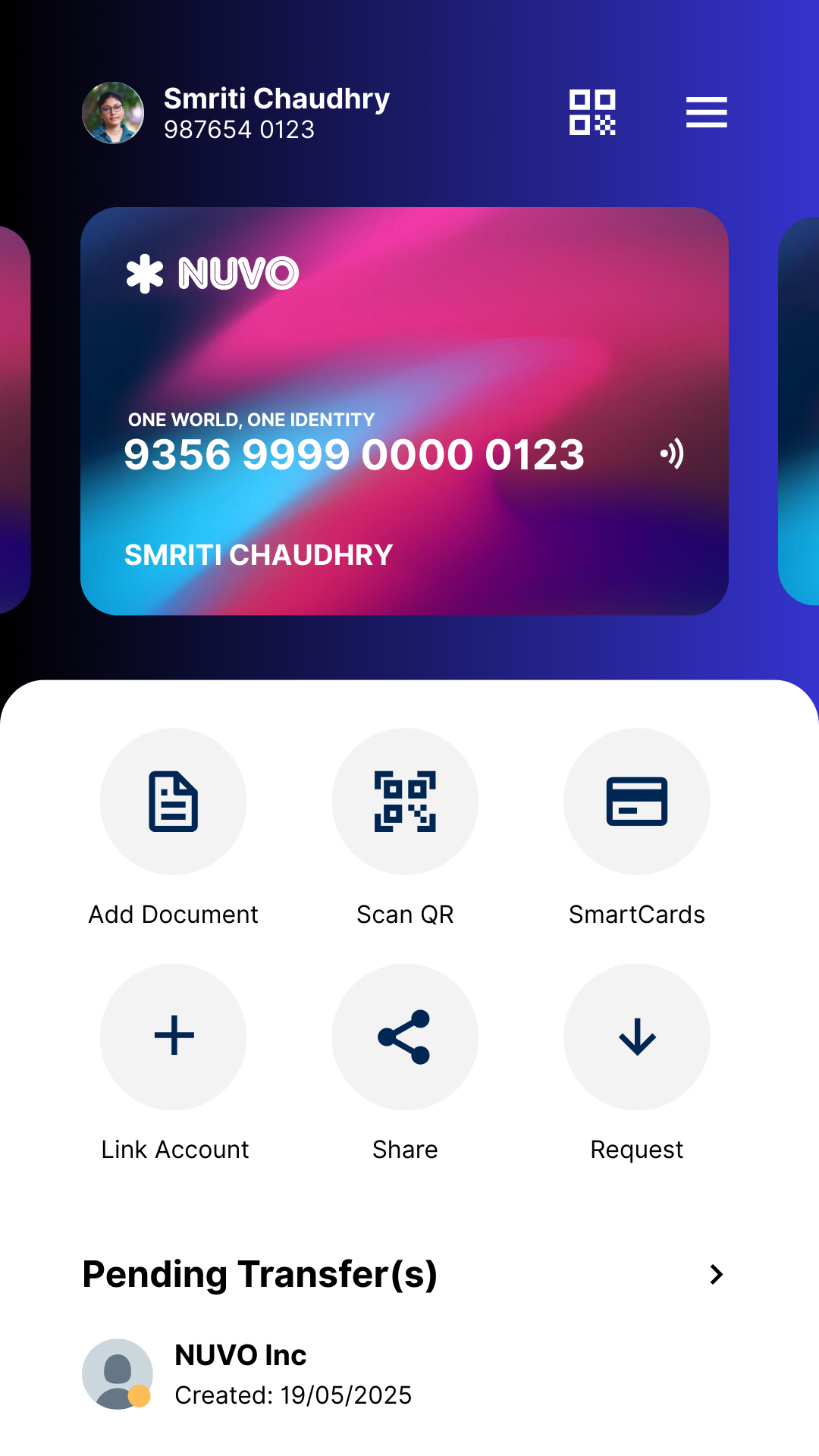

Create Account

Create Your AutoFinance Account, Complete KYC, Setup Personal & Business Account

AI Processing

Automated Transaction labelling, Real-Time Insights from Bank Statements Data

Automated Compliance

Generate Financial Statements and Projections, Collaborate with Tax Professionals

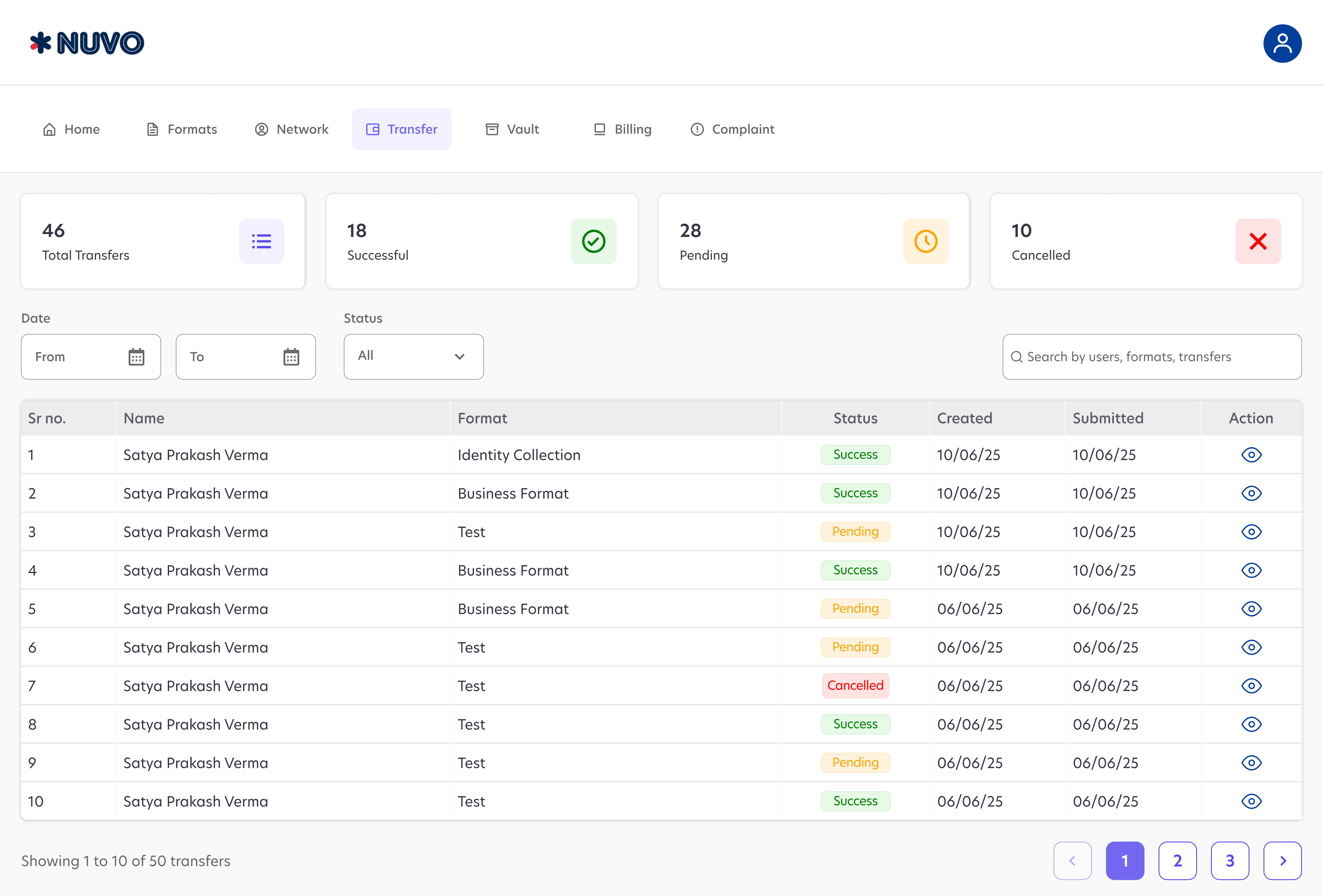

How Does it Work

AutoFinance provides a seamless solutions for managing financial insights from bank financial statements

Create Filing Data Request (CA)

Submit Consent-Based Financial Data (Users, SME)

AI Transactions Auto-Label and Analytics (Users, SME)

Collaborate - Bank Statement Suspense Resolution

Choose the Right Account for You

Take control of your financial future with our AI-ML powered solution. From effortless bank statement data extraction to generating key compliance reports, we simplify financial management for MSMEs and individuals. Seamlessly collaborate with your accountant and gain clear insights to make smarter financial decisions.

AutoFinance offers different account types to cater to your specific financial needs, whether you're managing personal finances, a small business, or an accounting practice.

User Personal

Individuals looking to take control of their personal finances, track spending, and build a clearer picture of their financial health.

SME Business

MSME owners and small businesses who need a powerful tool to manage their business finances, streamline accounting and ensure compliance.

Accounting Firms

Professional accounting firms and individual accountants who want to efficiently manage the financial data of multiple clients in one platform.

Feature Rich Modules

AI-ML Solutions to automate and save hours of effort in routine data management tasks.

Bank Statements

Extract Bank Statement Data using Advanced AI and LLMs

Real Time Analytics

Real Time Analytics and Insights into Financial Data

P&L Statement

Generate Profit-Loss from Bank Statement Analysis

Conversational Insights

Qeury Financial Data Insights with Generative-AI Chat

Financial Projection

Create Financial Projection Statements with AI-ML

Credit Card Statements

Process Credit Card Statements using Advanced AI and LLMs

Invoice Data

Streamline Data Analysis for Customer & Supplier Invoices

Data Vault

Stealine Financial Data Exchange with for Quick Turn-Around

Payments

Built-in Invoices & Payment for Financial Services

Frequently Asked Questions

Got questions? We've got answers. Find what you need here.

What is AutoFinance and who is it for?

AutoFinance is an AI-ML powered platform designed for MSMEs and individuals to analyze their financial data. It automates bank statement data extraction and generates comprehensive financial reports, helping you gain insights and manage your finances more efficiently.

How does the AI-ML bank statement data extraction work?

Our solution uses AI and machine learning algorithms to automatically scan, categorize, and extract transaction data from your bank statements. This eliminates the need for manual data entry, saving you time and reducing errors.

What types of financial compliance reports can the platform generate?

The platform can generate a variety of reports, including Profit and Loss statements, Balance Sheets, Cash Flow statements, and GST-related reports, depending on your data and the specific requirements for your business or personal finances.

Is the solution only for business use, or can individuals use it too?

While it's perfect for MSMEs and Financial Accountants, the solution is also designed for personal financial data analysis. Individuals can use it to track expenses, manage budgets, and understand their spending habits better.

Can I integrate my bank account directly?

The bank account integrations is planned for future updates. Once availbale, it will enable secure integration with a wide range of banks to automatically pull and analyze transaction data, subject to explicit consent.

How secure is my financial data on the platform?

We prioritize data security with end-to-end encryption and robust security protocols. All data is handled with strict confidentiality and is stored in compliance with industry standards.

What is the benefit of collaborating with accounting companies?

This feature allows for seamless collaboration with your chosen accounting professional. You can grant them secure access to your financial data and reports, making it easier for them to file taxes, conduct audits, and provide expert advice.

How do I share data with my accountant through the platform?

You can invite your accountant to the platform with a few clicks. They will get a secure, restricted login that allows them to view the necessary reports and data without compromising your security.

Can I revoke my Accountant's access to my data?

Yes, you have full control over your data. You can revoke access for any collaborator at any time through your dashboard.

Does the platform replace the need for a financial accountant?

AutoFinance does not replace professional accounting services. It is a tool to empower SMEs and Accountanting Professionals and Firms. It automates tedious tasks like data entry and report generation, allowing your accountant provider to focus on providing higher-level strategic advice and ensuring compliance.

How does the AI help in identifying financial insights?

Our AI-ML engine not only extracts data but also identifies patterns and trends. It can provide insights into spending anomalies, recurring expenses, and potential areas for cost savings, offering you a deeper understanding of your financial health.

Is there a free trial or a basic free version?

We offer a tiered pricing model that includes a basic free version for personal use, allowing you to experience the core features before upgrading.

How often is the data from bank statements updated?

The data is updated as soon as statements are uploaded into the portal. Statement Processing takes few minutes. This ensures your financial insights are always current.

Can the platform handle multiple bank accounts?

It is possible to upload bank statements from multiple accounts. In future, once banking integration is live, it will be possible to link and manage multiple bank accounts from various banks within a single dashboard, providing a consolidated view of all your financial activities.

What kind of support is available if I encounter an issue?

We provide dedicated customer support via email and a live chat function. We also have a comprehensive help section with guides and tutorials to help you make the most of the platform.

Automate, Collaborate, Grow

Use AI Data Analysis, Take control of your Finances. Collaborate with Accounting Services. Make Smart Financial Decisions.

NUVOWallet Innovations Private Limited

WeWork Galaxy, 43 Residency Road, Bengaluru, Karnataka, IN 560025

CIN: U62020KA2023PTC181680

Contact Us:

Sun 21/09/2025 09:14 PM

****** • ****** • ******